Improving your credit ‘s the unmarried greatest thing you can do to attenuate your own a lot of time-term refinancing will set you back Term search payment and label insurance coverage: That it $700 to $900 charge talks about the expense of searching brand new ideas making yes you happen to be truly the citizen,

- Term search payment and label insurance coverage: That it $700 to $900 charge talks about the expense of searching brand new ideas making yes you happen to be truly the citizen, and insurance the problems inside techniques.

- Tape commission: Which fee away from $40 so you can $100 pays local governments in order to technically listing their home loan data files.

How exactly to Down Refinancing Will set you back

The list of closing costs more than may seem overwhelming, and it can be eyes-beginning to see exactly how much refinancing very can cost you. But when you’re refinancing your mortgage is not low priced, thankfully you really have enough chances to reduce those charges.

Change your Borrowing

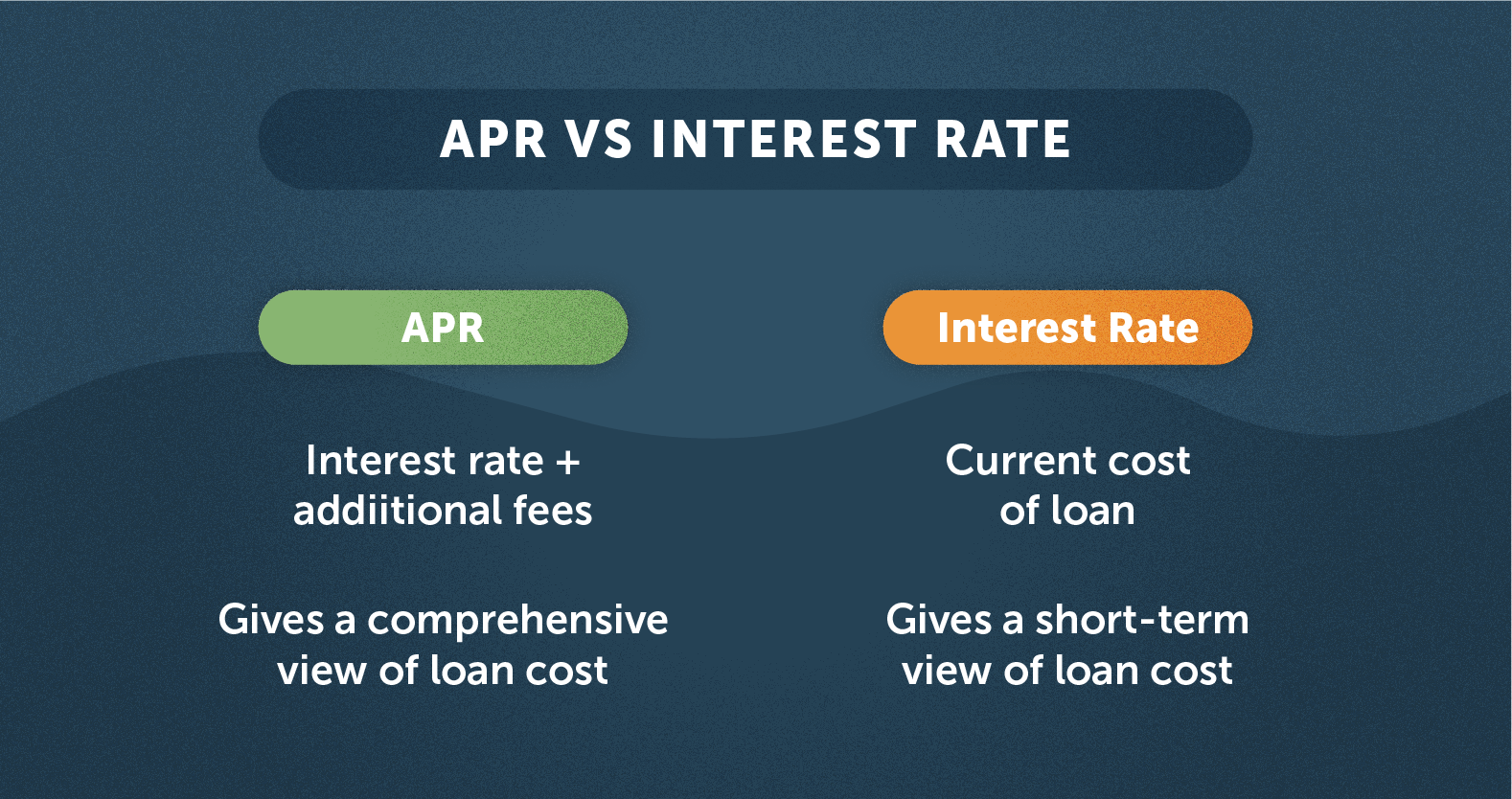

With a better credit rating, you might be able to get a lower interest rate, which is the biggest prices for the taking out a mortgage.

Enhancing your credit may take date, however, there are ways to start off now. Most of the suggestions comes down to three rules:

- Constantly shell out your expense punctually.

- Reduce (and ultimately clean out) your own personal credit card debt.

- Keep in mind your own credit file.

Buy an educated Speed

With good credit allows you to obtain a good rates. However, even if you might be still doing improving your score, certain loan providers usually still bring greatest prices as opposed to others.

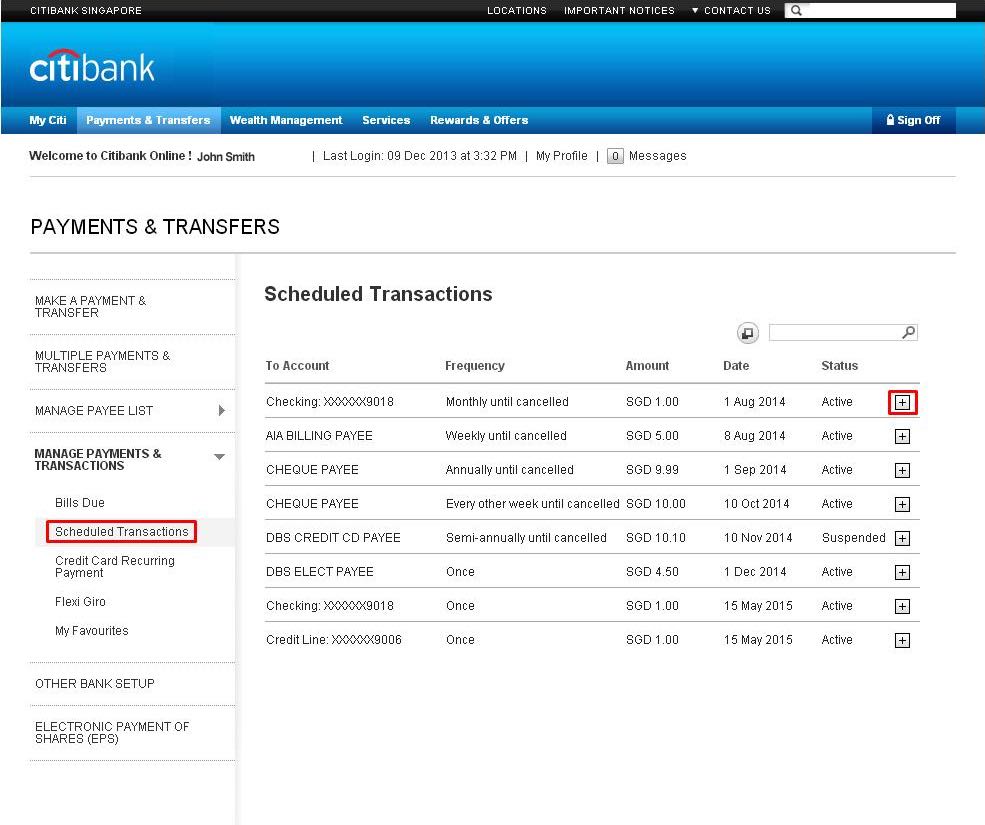

Is actually checking your own speed which have as many lenders as you are able to. Rate-shopping websites are helpful, however, ensure that you and contact regional credit unions so you can have the full range off solutions to you personally.

Negotiate Your own Settlement costs

Once you see a lender you like, they have to offer a formal financing estimate. The following webpage in the standardized document boasts a review of three style of closing costs:

- Bank costs (Section A beneficial)

- Functions you simply can’t look for (Point B)

- Attributes you could look for (Point C)

You can’t really do just about anything which have Part B, you could run Section A good and Point C. Review the lending company-particular costs during the Point A and try settling with your bank to 3k loan no credit check Granada CO reduce or waive some of the charges. The fresh new bad they may be able would are state zero, and you will be in identical status youre today.

To possess Part C, you might be in a position to look around for various inspectors, appraisers, surveyors, and so on. You will have to do this work oneself, and contact the lender when you’ve receive a less expensive replacement for.

Coming up with this new settlement costs whenever refinancing is a big adequate hindrance for many people you to particular loan providers render “no-closing-prices refinances.” You will possibly not have to pay something upfront in these instances, but you will nonetheless shell out those people will set you back in 2 chief means.

Earliest, loan providers can charge a higher rate of interest during these funds, thus they will sooner build right back the money they aren’t getting in the the beginning of your brand new financial. Second, lenders you’ll prompt one to roll every closing costs on financing, definition you should have a level huge harmony to pay off-and you will shell out a whole lot more inside the attract.

Long lasting approach your own lender spends, the end result is a similar: You have a higher payment than if you’d paid down the closing costs upfront, and thus, the loan tend to be more costly fundamentally.

The conclusion

Even if refinancing a loan will set you back a lot, you might however save money ultimately for individuals who get a lowered rate and you may/otherwise re-finance to possess a shorter title. The only method to know very well what your own refinanced mortgage could cost would be to work at the wide variety yourself using a mortgage re-finance calculator.

Personal financial insurance policies (PMI): Even if you did not have private financial insurance policies (PMI) on your own totally new home loan, it would be a part of the price so you’re able to refinance. Lenders typically need PMI when a purchaser provides below 20% offered equity in the home financing. The newest PMI covers the lending company however, if a debtor defaults for the financing.

We can assist you in deciding if or not refinancing is the best disperse for you in the current economy. We could make it easier to weigh up the costs as opposed to the pros out-of refinancing and you will explain if a new financing you will definitely greatest suit your financial situation and desires. Link now.

- What’s the FHOG?

Refinancing their financial normally present an easy way to lower your attention price and you will homeloan payment, otherwise cash-out home guarantee. As you plan ahead for 1, you might be thinking, Precisely what does it cost so you’re able to re-finance a mortgage? Is an instant report about prospective will cost you and things to consider.

Identity commission: A title commission are paid to help you a subject team you to definitely reports assets deeds and you can makes sure not one person more has a claim with the assets you are refinancing. This is labeled as a name search.

- Survey percentage: So it $150 in order to $400 charges guarantees your house together with structures inside are located in the right locations.

Leave a Comment

Your email address will not be published. Required fields are marked with *